Abstract

Background:

The use of artificial intelligence (AI) has been shown to enhance human life quality by making it easier, safer, and more efficient. However, there is currently limited evidence about the applicability of AI in health insurance and easing the complexity of insurance operations. This study seeks to systematically review the literature related to the application, challenges, and opportunities of applying AI in the healthcare insurance industry.

Methods:

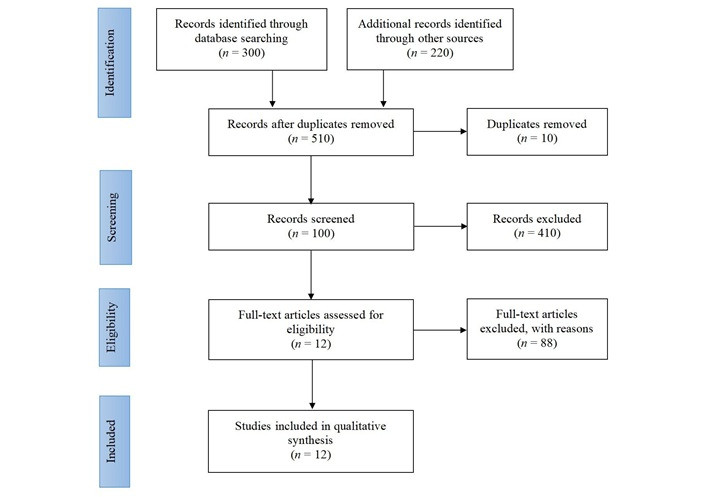

A systematic review approach was utilized, guided by the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) guidelines. The method included an exploratory and narrative design, a two-phase search strategy, eligibility criteria, and analysis.

Results:

The search yielded 520 eligible articles. Twelve articles were eligible, evaluated, and analyzed in this study. Most articles discussed AI’s use in healthcare insurance to detect fraud, improve underwriting accuracy and transparency, and resolve medical information asymmetry. For claim processes, virtual agents, chatbots, customer engagement, telematics, and underwriting, algorithms were essential. However, technical skill is needed to create and deploy AI systems, and privacy was an issue due to massive data and algorithms that could abuse user data.

Discussion:

The implementation of AI encounters various challenges, such as insufficient knowledge among users, a deficit in technical expertise and support, shortcomings in data strategy, and a growing reluctance towards AI. Privacy presents a challenge in AI, especially because of the widespread use of large data sets and algorithms that could misuse consumer information.

Keywords

Artificial intelligence, healthcare, systematic literature review, healthcare insurance, machine learning, medical informationIntroduction

Healthcare insurance is a system designed to finance medical expenses. Key components often associated with health insurance include premiums or taxes, fund pooling, and eligibility for benefits. There is a positive relationship between health insurance and health-related outcomes [1]. Many healthcare facilities and countries have relied on health insurance to improve health outcomes and the overall health of their citizens [2]. The consistent use of health insurance in healthcare has shown positive correlations with specific health conditions that require regular engagement with hospitals, physicians, or other health facilities. The presence or absence of health insurance can predict the costs incurred by patients, the use of medical care, health outcomes, and overall health status or mortality within populations [1].

Despite the significant benefits of health insurance, several challenges persist. Underwriting, for instance, can be a time-consuming process that requires meticulous assessment of information [2]. Similarly, ongoing innovations in healthcare have ushered in an era of big data, which can complicate underwriting efforts, leading to difficulties in setting premiums and potential misalignment of policies with specific populations. Collectively, some of the key issues facing health insurance include difficulties in risk assessment, premium determination, preventive medicine, fraud, rising healthcare costs, competition, and customer care [3].

Given these challenges, technologies have demonstrated their potential in both the healthcare and insurance sectors [4]. In particular, the field of artificial intelligence (AI) has made significant strides in healthcare due to the numerous benefits it offers. Globally, the AI industry is rapidly advancing and continues to be developed for efficient application across various sectors [5]. However, the full potential of AI has yet to be realized due to a talent gap in this technology and a lack of understanding of its application, challenges, and opportunities across different sectors [6]. Based on these observations, we hypothesize that AI can play a significant role in healthcare insurance and has the potential for growth within the insurance sector, thereby leveraging the benefits associated with its use.

As healthcare continues to innovate, a wealth of information is generated, including data on the application of healthcare technologies. The presence of big data poses challenges for providers and insurance underwriters in risk assessment and policy generation, balancing service provision, resource utilization, and patient demand. Thus, this paper aims to identify the needs and uses of AI in health insurance and how AI can transform insurance underwriting. It will also explore the challenges associated with using AI in health insurance. Understanding these challenges can serve as a platform for managers to make informed decisions on mitigation and improvements in the use of AI in healthcare insurance.

Materials and methods

Study design

This systematic review employs the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) guidelines. The methodology used in this research was meticulously designed to ensure a comprehensive and unbiased review of the existing literature. Such a thorough approach offers a systemic way to collect and analyze relevant studies comprehensively, paving the way for a robust interpretation of results in the subsequent sections (Table 1).

Boolean operator use

| Boolean operator | Use |

|---|---|

| And | AI and IT |

| Or | Healthcare IT or healthcare AI |

| Quotation marks | “Healthcare AI”, “Impact of healthcare AI”, “IT”, “IT innovations in healthcare”, “AI in insurance”, “AI in healthcare insurance”, “AI and big data in healthcare” |

| Parenthesis | Impact of AI (in healthcare) |

Search strategy

We used broad healthcare and AI terms in several databases: PubMed, Medline, and Science Direct to search for papers published between January 2018 and January 2024 to identify articles within the requirements and eligibility criteria of this systematic literature review. From all the identified articles, we reviewed each to ascertain the author’s authenticity, identify the journals in which they were published, and list the references used for each relevant article. After reviewing the reference lists, we applied the eligibility guidelines to filter out irrelevant or less relevant articles.

Eligibility criteria and study selection

The criteria for inclusion entailed a consideration of several conditions:

(1). Articles with the aim to examine the impact or role of AI on the healthcare insurance industry.

(2). Published studies between January 2018 and January 2024.

(3). Published in English.

Papers that failed to meet such criteria were excluded from the review.

Together, two authors checked each collected paper for eligibility. First, we looked through the titles and abstracts of the papers to eliminate duplicates. After that, we completed the selection by reading each of the remaining papers. All disagreements were settled through conversations between the reviewers to reduce the possibility of selection bias.

Data collection and synthesis

We relied on a data extraction form, which was based on the Cochrane Effective Practice and Organization of Care Review Group (EPOC) data collecting checklist [7]. We extracted study characteristics (e.g., authors, date, study type, and design) and outcome characteristics (e.g., applications, challenges, and opportunities of AI).

Assessment of risk of bias in the included studies

The two authors used the Prediction Model Risk of Bias Assessment Tool (PROBAST) criteria to assess the risk of bias in all qualifying studies (31). A third reviewer confirmed their judgments.

Results

A total of 520 distinct records were found. Of which 510 papers made it through the title and abstract screening process and were ready for full-text review. In the end, 12 papers satisfied our inclusion requirements (Figure 1). The papers in Table 2, ordered chronologically, showcase the evolving research trends in this field. These papers employ diverse methodologies, including qualitative and quantitative approaches. The evolution of research over time reveals a growing and maturing understanding of AI’s role in healthcare and insurance, with a clear trend towards identifying more sophisticated applications and nuanced challenges.

Characteristics summary of the 12 selected publications

| Number | Title | Author | Date | Type | Study design | Identified applications of AI | Identified challenges facing AI | Identified opportunities |

|---|---|---|---|---|---|---|---|---|

| 1 | Legal status of artificial intelligence-based health insurance services: Challenges, opportunities for customer protection [8] | Riyanti R | 2022 | Cross-sectional | Quantitative study | N/A | Legal challengesSecurityPrivacy | N/A |

| 2 | Explainable Artificial Intelligence (XAI) in Insurance [9] | Owens E, Sheehan B, Mullins M, Cunneen M, Ressel J, Castignani G | 2022 | Systematic review | Qualitative study | Fraud detectionClaims reserving | N/A | Claims managementInsurance fraud detection |

| 3 | AI Insurance: How Liability Insurance Can Drive the Responsible Adoption of Artificial Intelligence in Health Care [10] | Stern AD, Goldfarb A, Minssen T, Price II WN | 2022 | Literature review | Qualitative study | Insurance product pricing | ReliabilityUncertainties | N/A |

| 4 | Blockchain and AI-Empowered Healthcare Insurance Fraud Detection: an Analysis, Architecture, and Future Prospects [11] | Kapadiya K, Patel U, Gupta R, Alshehri M, Tanwar S, Sharma G, Bokoro PN | 2022 | Cross-sectional | Quantitative study | Fraud detection | SecurityPrivacyFraud issues | N/A |

| 5 | Machine Learning-Based Regression Framework to Predict Health Insurance Premiums [12] | Kaushik K, Bhardwaj A, Dwivedi AD, Singh R | 2022 | Literature review | Qualitative study | Insurance pricingUse of chatbotsClaim settlementPersonalized health insurance policiesCost-effectivenessUnderwriting | N/A | N/A |

| 6 | Key Principles of Clinical Validation, Device Approval, and Insurance Coverage Decisions of Artificial Intelligence [13] | Park SH, Choi J, Byeon JS | 2021 | Cohort study | Quantitative study | Insurance coverage decisions | N/A | N/A |

| 7 | Algorithms in future insurance markets [14] | Śmietanka M, Koshiyama A, Treleaven P | 2021 | Literature review | Qualitative study | Personalized product offeringsBehavioral product pricingRisk assessmentFraud detection | Data strategyInadequate technical knowledgeAversion towards AI | AutomationSecurity |

| 8 | Improving the Accuracy and Transparency of Underwriting with Artificial Intelligence to Transform the Life-Insurance Industry [15] | Maier M, Carlotto H, Saperstein S, Sanchez F, Balogun S, Merritt S | 2020 | Cross-sectional | Quantitative study | Underwriting | N/A | N/A |

| 9 | Artificial Intelligence (AI) in Insurance: A Futuristic Approach [16] | Gupta R | 2020 | Review | Qualitative study | Chatbots, machine learning, robotic process automation (RPA), robo-advisorsFraud detectionAccurate decisionsProvide better coveragePrice risk abilities | N/A | Cross-selling opportunities |

| 10 | Artificial Intelligence in Insurance Sector [17] | Kumar N, Srivastava JD, Bisht H | 2019 | Literature review | Quantitative study | TensorFlow, Fukoku, H2O.ai, Bots, APIsPortfolio innovationsOptimizing sales and marketingImproving customer experienceInsurance fraud | N/A | N/A |

| 11 | How AI is changing the insurance landscape [18] | Corea F | 2019 | Review | Qualitative study | Buying and pricing insurance products | N/A | N/A |

| 12 | Resolving asymmetry of medical information by using AI: Japanese people's change behavior by technology-driven innovation for Japanese health insurance [19] | Yamasaki K, Hosoya R | 2018 | Case study | Qualitative study | Data organization (resolving asymmetry) and analysis | N/A | Innovations |

N/A: not applicable

Study characteristics

Of the included articles, four provided an overview and demonstrated the applicability of AI in healthcare [16–18]. Most of the included articles also identified viable AI applications in healthcare insurance. Explainable AI was the most significant, while other algorithms were identified as fundamental in establishing healthcare insurance AI applications [9]. Several of the included articles highlighted the importance and application of AI in healthcare insurance for tasks such as fraud detection, improving underwriting accuracy and transparency, and resolving medical information asymmetry [9–11, 17, 19]. One article addressed the legal status of AI in health insurance [8].

AI in healthcare

AI was considered beneficial to the insurance sector, especially with the ongoing innovations in new algorithms. Despite facing the complexities of information and big data, strong regulations, high levels of fraud attempts, and feature complexity, the health insurance sector could leverage significant benefits from the use of AI [11]. Various studies have identified that AI will not only enhance customer engagement and retention and reduce costs but will also help people become more aware of risks and habits, thereby enabling better pricing and risk assessment [12, 17].

Insurance-based AI applications and benefits

Algorithms were identified in multiple resources as playing a major role in developing health insurance AI applications. Algorithms were found to be integral in claim processes, creating virtual agents and chatbots, inducing customer engagement, creating telematics, and underwriting. Case studies of insurance applications were also identified in a resource. Among the cases are AXA (AXA achieved 78% accuracy while AI applications implemented by Fukoku Life Insurance and IBM Watson saw a 30% increase in productivity), Transamerica, and H2O (improved product recommendations, marketing campaigns, and effectiveness in selling) [17]. Given these results, it is arguable that AI and related algorithms are all seen to have a positive impact on health insurance. AI and AI-based analytics have been observed in multiple resources to improve health insurance. Essentially, machine learning (ML) can be leveraged to automate and personalize product offerings, improve behavioral product pricing (through the use of telematics), and improve risk assessment [12, 20]. It is also essential for enhancing fraud detection and business process automation. AI-powered robot legal advisers could also provide lawful choices and judgments in terms of claims and implications within the legal framework process [16].

Challenges and opportunities of AI in the healthcare insurance industry

Several challenges have been identified in the use of AI in health insurance. Among them is a lack of technical know-how, which is implicated in the implementation and deployment of AI applications [14]. Both the AI and insurance sectors are rapidly evolving, which can lead to inadequacies in data strategy. There are also aversions towards AI, with arguments suggesting that AI users need to be convinced about the importance and usability of AI in health insurance. Privacy also poses an issue in AI, especially considering the existence of big data and algorithms that could potentially exploit customer information.

Significant advancements in healthcare insurance continue to emerge. As trends and advancements emerge, several opportunities can be leveraged. Literature indicates several opportunities spanning innovations, improvements in security and privacy for patient data, as well as the viability of automation for several healthcare insurance operations [14]. Opportunities also exist in the development of applications for claims management and fraud detection, which can help advance the Saudi Arabian insurance industry [9]. Cross-selling opportunities also emerge, potentially filling a viable gap within the insurance sector [16].

Discussion

In light of the viability of AI in the insurance industry, several applications have been developed and have continuously been used in the insurance sector. A variety of algorithm-driven applications have emerged in the industry, demonstrating the tangible impact of AI in this field. The first is AI-powered chatbots, which act as virtual assistants leveraged by insurers to help improve customer satisfaction. Chatbots, which are increasingly replacing human assistants, improve the speed of service delivery and overall efficiency. Chatbots provide 24/7 assistance, making them economical and preferable. Some chatbots identified include GEICO, Palo Alto start-up Lemonade, Lincoln Financial, TOMI Chatbot, Tractable, Trov, and Allstate [16]. ML algorithms also exist in the insurance industry, offering predictive analysis, product design, and usefulness in fraud detection and risk management/evaluation. An example of ML software in the insurance industry is KironMed (from KironTech), which aids in analyzing medical claims and detecting fraud. Another application is NLP (tech analytics and natural language processing), which are digital technologies addressing customer engagement and experience. Another application of AI in insurance is the use of robotic process automation (RPA), which helps conduct similar and repeatable tasks. Automation reduces work pressure and provides end-to-end solutions, hence enhancing the customer experience.

There were several case studies involving the application of AI in the insurance sector and healthcare. TensorFlow was identified as one of the software used in predicting potential losses and optimizing prices for insurance policies. This showed a viable application of AI in the insurance sector (which can also be adopted in healthcare insurance) [17]. Another application is the use of IBM Watson Explorer, which entailed an AI application automating the claim process and calculating claim payouts. This had a significant impact on the development of similar AI algorithms. Another application is the use of H2O.ai by Transamerica, which asserts better product recommendations, better marketing campaigns, and improved customer service. The identified AI applications are just a few, given that the growth of AI application development continues to grow, and innovations continue to take shape regarding AI and insurance.

Although AI technology is still in its early stages of development, its current capabilities demonstrate tangible real-world applicability and effectiveness. As AI has substantially improved, its enhanced capabilities have broadened its potential applications within the insurance sector. The insurance sector could leverage the essence of AI and its continuous development. The insurance sector entails scenarios where big data is generated while entailing aspects that would be able to leverage AI capabilities, hence improving the overall outcomes. AI abilities can enhance the value chain within the insurance industry by altering relationships, reinventing how insurance is conducted, and expanding the applicability of large data within the industry. Insurance companies can apply AI to enhance their approach to large data analytics. By developing algorithms that facilitate data transfer and combining data, they can achieve better insights for underwriting, risk management, and pricing. With big data and AI, insurance companies, particularly in healthcare, could discover better ways of conducting insurance activities and improving loss and risk handling. By incorporating AI technologies, insurance companies have the potential to achieve high overall performance, increase their market base, and enhance the customer experience. AI also has the capability of helping managers create innovative products while drawing valuable insights that, in essence, improve business processes, managerial approaches, and customer service. Insurers should prepare for accelerating changes within the insurance industry. Undoubtedly, the increasing emergence and adoption of AI in insurance signifies a profound transformation relating to automation, deep learning, and the development of data ecosystems (data analysis) [17, 18]. The imminent changes are likely to significantly improve the performance of the insurance sector; hence, it is important to develop coherent strategic plans that will help in AI exploration, adoption, and innovations to help attain the benefits of using AI in insurance.

Despite the increased application and algorithms and their stated benefits, there are still challenges emerging regarding AI in insurance. One significant challenge is the industry-wide lack of technical expertise necessary to develop and utilize AI applications [14]. Technical know-how relates to the development and/or usage of AI in insurance. For example, using a supervised type of algorithm requires human intervention to define elements of input and output data, ensuring the objectives are met. Therefore, if those users lack the technical expertise and there is less or no technical support offered, the use and application of such algorithms will have no significant outcomes. Therefore, a lack of technical know-how somewhat implicates the implementation and deployment of AI applications. The dynamic nature of both AI and the insurance sector often leads to challenges in formulating an effective data strategy. This dynamism is characterized by the diversity in data, data type, data sources, and the usage of such data. Therefore, pulling all the data together and managing it is a challenging task. With a proper data strategy, managers may be able to leverage the benefits of AI in insurance. Another challenge is the aversion to AI, arguing that AI users ought to be convinced about the importance and usability of AI in health insurance [14]. Lack of trust, knowledge, and skills to use AI applications will lead to aversions that limit the adoption of AI tools in insurance. Privacy is also an issue in AI, given the existence of big data and algorithms that exploit customer information [11].

Our review has some limitations. Publications that met our inclusion criteria and operational definition of AI and healthcare insurance are included in this study. Thus, our search strategy may not have captured all relevant records. Additionally, only papers published in English during the past 8 years were included in our review. Despite such limitations, the findings provide valuable insight into the applicability of AI in healthcare insurance and pave the way for more research in the future.

In conclusion, insurance needs AI. As discussed throughout, AI might transform the insurance industry for the better. After AI’s viability in healthcare, the interoperability between AI, healthcare, and insurance has enabled the emergence of AI applications in the insurance industry, improving insurance companies’ goals, operations, and alignment. Healthcare and insurance organizations can use AI to improve their huge data analytics methodologies. Better underwriting, risk management, and pricing insights can be achieved by improving data transmission and integration algorithms. AI in insurance also faces obstacles. As shown, AI implementation is hindered by user ignorance, technological incompetence, data strategy flaws, and growing resistance to AI. Additionally, AI skills and trust are lacking. AI still revolutionizes insurance. Based on the benefits exploited and the possibility for future advancements, AI in insurance is still in its development stage and can grow, benefiting the insurance business.

Abbreviations

| AI: | artificial intelligence |

| ML: | machine learning |

| PRISMA: | Preferred Reporting Items for Systematic Reviews and Meta-Analyses |

Declarations

Author contributions

AAA: Conceptualization, Data curation, Methodology, Writing—original draft, Writing—review & editing. SA: Data curation, Writing—original draft, Writing—review & editing. Both authors read and approved the submitted version.

Conflicts of interest

The authors declare that they have no conflicts of interest.

Ethical approval

Not applicable.

Consent to participate

Not applicable.

Consent to publication

Not applicable.

Availability of data and materials

Data is available upon reasonable request.

Funding

Not applicable.

Copyright

© The Author(s) 2025.

Publisher’s note

Open Exploration maintains a neutral stance on jurisdictional claims in published institutional affiliations and maps. All opinions expressed in this article are the personal views of the author(s) and do not represent the stance of the editorial team or the publisher.