Affiliation:

Innovation Management Doctoral School, Óbuda University, 1034 Budapest, Hungary

Email: melissza.salling@gmail.com

ORCID: https://orcid.org/0000-0003-4445-3469

Explor Foods Foodomics. 2025;3:101064 DOI: https://doi.org/10.37349/eff.2025.101064

Received: August 22, 2024 Accepted: December 12, 2024 Published: January 15, 2025

Academic Editor: Charles Odilichukwu R Okpala, University of Georgia Athens-GA, USA

Aim: African swine fever is a viral disease that has affected the pig business in several nations worldwide. One of the most serious diseases affecting the hog business significantly influences China’s meat sector, as the country is one of the biggest pork consumers. The main objective of the current study is to examine the impact of the breakdown on hog meat output and prices in the China region. Several factors, such as market supply and demand, disease outbreaks, and governmental policies, have caused fluctuations in the price of pigs in China since 2018.

Methods: The acquired data was first evaluated using a descriptive technique. The price fluctuation caused by African swine disease during the studied time was then evaluated using a t-test, Pearson’s correlation coefficient system, and polynomial regression.

Results: In the analyzed period from 2015 to 2021, African swine fever outbreak impacts were detected in pork supply and price distribution. The outbreak lowers the output of hog meat, raising the stock price and influencing other meat products’ prices. Polynomial regression analysis employs the correlation between the decreased level of pork supply and the increased price of live pigs. The price of live pigs ranged from 10.57 RMB/kg to 37.10 RMB/kg, with a median of 15.60 RMB/kg and a mean of 21.43 RMB/kg. This suggests a significant increase in prices in comparison to stock levels, which could be a sign of the impact of exogenous disruptions of African swine fever on market dynamics.

Conclusions: Findings emphasize that such disruption has a negative effect on the supply and demand balance. Moreover, it negatively affects pork production and price distribution. The results highlight that prices are increasing significantly as a consequence of viral outbreaks and decreased pork production.

Alimentation has a long history, and it can be understood as the essence of living factors that date back to the creation of life. Because humankind has interacted with nature concerning its survival, food and its preparation are a part of daily life. Meat consumption is a complex phenomenon related to different aspects such as living standards, diets, livestock production, culture, consumer prices, macroeconomic uncertainty, and shocks to gross domestic product (GDP) [1]. The patterns of global meat consumption have changed dramatically over the past fifty years, pressuring the environment and leading to unbalanced diets, particularly in developed and emerging countries [1]. According to the Organization for Economic Co-operation and Development (OECD) [2], meat is more expensive to produce and purchase than other commodities. After all, meat production is a complicated process that requires high standards and output to satisfy the public or meet consumer demand. As a result, higher income levels are linked to increased meat consumption. Additionally, as living standards have changed, so too have dietary habits. Fresh products, such as fresh meat, fresh vegetables, and fruits have a typical lifetime in which they can be used or processed, therefore in the supply chain, and world economics a decay, like a viral disease, contamination could be very harmful to an industry, as well as for other economic factors, by creating huge uncertainties [3]. Throughout the years we could note some viral outbreaks that affected the fresh produce industry, meat industry, or dairy industry [4, 5]. African swine fever (ASF) (hereinafter, ASF) is one of the most severe diseases in the farm industry referring to pork production in recent years; ASF is considered a transboundary infection that is caused by the Asfarviridae virus family which has an almost 100% death rate [6]. Referring to the research of Dixon et al. [7], although there is no evidence of human endangering, ASF has a damaging impact on swine numbers and the farming sector. The virus is highly resistant to the environment, enabling it to survive on goods like apparel, footwear, and other items, thus, the spread of the virus is easy from one herd to another, as well as by the farmer, moreover, as pig meat has a wide range of products, the virus can also get in the circle of supply chain. The inflammation could persist in pig products, such as bacon and sausage; as a consequence of inappropriate measures, human behavior may spread this disease among pigs [7].

According to Dixon et al. [7], the international expansion of ASF has harmed the development of the swine industry, especially those running family farming. According to the research, pork is one of the primary sources of animal proteins, accounting for more than 35% of the meat consumed worldwide, but as a consequence, the disease deeply imperils the safety of the world’s food supply [7].

An incurable disease and an epidemic could have troubled China, moreover, an initial outbreak in 2018 and 2019 killed millions of herds, as well as caused a high level of decrease in meat production that shocked international markets [8]. Referring to the research of Ma et al. [8] even if Chinese farms have significantly improved their hygiene and operating practices, the virus is spreading continually, especially peaking in winter. The scale of the crisis in just one month exceeded that in 2022. A key solution could be the fact of how quickly a farm or the pig company manager reacts and discovers the impact of a viral infection [9].

The present paper evolves a key understanding of meat consumption in China and assesses the ASF effects and impacts on prices in the market. The significance of the present study is to highlight the effects of the ASF, as well as to understand how it affects the price level and consumption habits of people.

The major contribution of the present research has been developed to quantify the consequences of the ASF viral outbreak and support better-informed managing decisions to prevent possible outbreak effects reflected in price distributions. In addition, offering a theoretical foundation of how supply-demand acts in the market in case of disruption. Analyzing price fluctuations due to disruption can help conduct deeper managerial decisions to mitigate disruption in the market. A range of statistical methods were used to evaluate the level of the impact of the ASF on pork meat production and price level and highlight consumer reactions. This article offers multidisciplinary knowledge in food safety, food policy, medical testing, innovation science, and veterinary science, among others.

According to the research of Ma et al. [8], the ASF epidemic in China began in 2018 and has had significant effects on the country’s pork business; as a result, hog farms were the most easily affected on a large scale and considerably impacted by the ASF epidemic. The effects of the ASF outbreak on the technical effectiveness of the swine industry may vary by different regions. According to scholars, after the ASF pandemic spread to China, the price of feed, medical expenses, epidemic management costs, and other costs associated with hog farming all sharply soared [7, 8].

Disruption as an impact of infectious disease is a huge threat to production in livestock markets. Infectious diseases could be a danger to the health of human, and animal stock, as well as decrease productivity. As a consequence, infectious diseases of farm animals could affect the balance of supply and demand, which could result in price increases or diminishment, all resulting from the nature of the price inelasticity of the product [10].

According to Marsh et al. [11], animal diseases, particularly transnational or transboundary animal diseases (TADs), could have important economic consequences on farms, at local and global levels due to the possible losses in livestock production, and consequently the high costs of prevention, control or elimination measures. The possible outcomes on a regional level or worldwide depend on the disease, its level of spread, the structure of the market and industry of the affected livestock, and the control and measurements of prevention during the epidemic period. Given the above, such disruption could also have an impact on social effects.

In the early 1900s, ASF—a fever that killed almost all afflicted domestic pigs—was initially identified in East Africa. Kenya published the first ASF case in 1921. It spread over several sub-Saharan African nations in the ensuing decades, but it stayed on the African Continent until 1957 [12]. It was discovered that the infection-causing virus came from an ancient sylvatic cycle. Between 1957 and 1960, ASF initially expanded trans-continentally to Portugal, after which it spread to other countries in Europe, the Caribbean, and Brazil. When Georgia published its first case of the ASF in 2007, a new phase of transmission started, and it later expanded to other parts of Europe [7]. Despite years of suffering in Europe, ASF was not discovered in Asia until August 2018. It impacted more than a dozen other Asian nations and spread more quickly in China than in other areas [12]. Genotype II, which has up to 99.95% genomic sequence homology with strains discovered in Georgia, Russia, and Poland, was the first ASF to be transmitted into China [13]. In 2018, eight provinces reported 25 outbreaks in August and September. After that, ASF outbreaks skyrocketed, peaking at 53 cases in October and November—a 112% rise could be observed over the previous two months. Additionally, eighteen provinces were present [13]. In addition, there were 26 outbreaks in thirteen provinces in December 2018 and January 2019; after this time, there were 50.9% fewer outbreaks and 27.8% fewer provinces affected by outbreaks. Following, eleven provinces reported 12 outbreaks in February and March. While outbreaks occurred in three additional provinces, the number of epidemics reduced by 53.8%, showing a 40% decline. Moreover, during April and May 2019, outbreaks were noted in twenty provinces, including Shenyang, Liaoning, Zhengzhou, Henan, Lianyungang, Jiangsu, Wenzhou, Zhejiang, Wuhu, Anhui, Inner Mongolia, Heilongjiang, among others [13].

The outbreak in China led to several problems, including a shortage of pork, fear among pig farmers, and fraudulent medicine and vaccination sales. In China, 160 ASF outbreaks were documented between the first report and November 22, 2019, leading to the slaughter of 11,930,000 pigs. The entire nation and pig farms have suffered significant losses as a result of the outbreak. Two large-scale pig farms, for example, were cleared: one in Mingshui, Heilongjiang, with 73,000 pigs, and another in Siyang, Jiangsu, with 68,969 hogs [14]. In 2018, a significant overhaul of the Chinese governmental system took place. Every step of the ASF prevention and control and pork supply recovery process, including precaution, the removal of infected pigs, pig culling subsidies, pig farm restoration, and pig allocation, reflects the coordination between various ministries and departments under the united leadership of the central government [15].

At the governmental level, actions were taken to monitor and prevent the virus’s spread. These included implementing important preventative measures, improving the biosecurity protection level, and prevention measures in pig farms. Moreover, to normalize the two-part quarantine management for live pig production facilities. First and foremost, the China Ministry of Agriculture and Rural Affairs oversees the rigorous implementation of the quarantine management system. To improve the distribution of live pigs and related products and transportation management, the China Ministry of Agriculture and Rural Affairs and Ministry of Public Security carry out the second component, which states that unlawful certification of authorized quarantines shall be severely penalized. Compared to small- and medium-sized farms, the expenditures of feed, medical care, and epidemic prevention rose by an average of 3.9% and 13.6% per year for large-scale hog production between 2018 and 2020; the findings indicate that hog farming does not fully fall under the definition of economies of scale. A farm’s exposure to market risk rises with size therefore, the Chinese pig business had an impact on both the domestic and international levels [13–15].

Based on the research of Nguyen-Thi et al. [16], such occurrences besides social and economic effects could also affect concerns in food safety, consumption patterns, and other key players along the value chain, such as traders, slaughterhouses, and retailers. According to the World Organization for Animal Health [17], ASF is responsible for enormous losses in pig production. Such infectious disease has become a major crisis for the pork industry in recent years and has changed some factors in the global value chain; the virus currently has been affecting several areas around the world which besides the impacts on biodiversity and the livelihoods of farmers, also has an impact on global supply chain and economics.

Following Ohouko et al. [18], in Benin between the assessed years of 2014 and 2018, the economic cost of the impact of ASF resulted in USD 1,513,340. In 2001, the cost of the epidemic in Nigeria was USD 941,492 due to the high mortality (91%) in 306 farms [19]. The disease in Tanzania resulted in USD 41,065 [20]. Outside of African areas, ASF had important effects on swine production in the People’s Republic of China, by increasing the price of livestock from about 13 RMB/kg to 38 RMB/kg [21], in other words, it tripled the price of the live hog. According to Nguyen-Thi et al. [16], in Vietnam, 20% of pigs died or were culled within the first 5 months after the outbreak, where the economic influence in 2019 resulted in between USD 880 million and USD 4.4 billion. In India, the cost loss due to animal infection between the period from April 2020 until June 2021 was estimated at USD 37.32 million [22]. According to the Food and Agriculture Organization of the United Nations’ (FAO) report [23], food prices have risen due to the virus outbreak worldwide, thus we can observe an increasing tendency by February 2021. U.S. maize prices have been rising also due to the higher demand in China [24]. Referring to the research of Huang et al. [21], China is the largest producer and consumer of swine across the globe. Pork, as the major nutrient of meat consumption in China, is a basic component of the food supply, national economy, and sustenance of people. Hence, it is of key importance to keep and maintain the supply of pork to guarantee national food security and stability in economic and social terms [21].

According to You et al. [25], scholars are evaluating the possible outcome and economic losses of the epidemic between the period of 2018 August and 2019 July by using an output and input model. The findings show that economic damage stands for a 0.78% fall in the GDP in China. The results show that taking immediate ASF containment and preventative measures could be vital to prevent further outbreaks and economic downturns. The effects of the outbreak at various scales on pig prices and the pricing of other food kinds and animal feeds are examined using two interconnected global economic models, as a consequence, according to the research, pig prices would rise by 17% to 85% worldwide, and other meat prices will also rise due to unmet demand; the demand for pork declines due to the price increase and due to health issues, but other countries’ output increases, and imports may cover half of China’s losses [9]. According to the research of Brown and Bevins [26], ASF outbreaks could be linked to imported infected livestock. Research proves that in most cases in China, farmers raised pigs at a low space utilization rate with a low infrastructure causing poor pig quality, which impacted the low resistance to the influence of the disease, also making epidemic tracking and control difficulty. The research discusses that pork was consumed per person at 20.1 kg in 2017, around 75.3% of all meat consumed. As a result, the price of swine meat varied a lot throughout 2019 [27]. Yunnan Animal Disease Prevention and Control Center provided a diagnosis report on March 2, 2021, in which the research presents that piglets transported even if tested positive for the African swine flu epidemic. In the car were 36 piglets, 6 of whom were sick and 6 dead [27]. A rapid implementation was needed, as well as an emergency plan that included the culling and harmless treatment of all piglets and the complete cleaning and disinfection of suitable locations, nearby roads, and transport vehicles, in order to stop or reduce the spread. Investigation and tracking of the epidemic condition are constantly developing.

Ma et al. [8], examined the 2018 ASF outbreak in China as a pattern of possible market integration, moreover, they used a novel spatial network model to quantify the strength of market cooperation across provinces and regions before and after the ban and a particular dataset of weekly provincial pork prices. The average loss of direct finances caused by death and slaughter throughout the Chinese provinces was USD 8.7 million in each area, and far more than 50% of the sections lost over USD 4.5 million. The region of Liaoning suffered the most severe financial losses from ASF, totaling USD 55 million. Additionally, the economic loss from lowered breeding due to ASF deaths and the culling of breeding swine is anticipated to be USD 681 million, according to official data from the China Ministry of Agriculture and Rural Affairs and the Infrastructure Investment Bank of Asia [28, 29]. Another research shows that as an indirect loss, it is projected that manufacturers across all 149 sectors of the China economy suffered indirect economic losses totaling USD 14.5 billion, ranging from USD 2.2 billion in the area of Guangdong to USD 1.4 million in Qinghai province. Other areas or regions sustained losses ranging from USD 100 million to USD 900 million, and the average indirect economic cost to producers was USD 467.8 million per province. The most severe financial damage could be seen in the eastern coastal, central, and southern regions. These findings represent that the ASF disease, which has caused substantial financial losses, consequently affected the swine industry and practically, all other sectors of the economy [24].

To create a thorough defense for the investigation of the subject matter, a wide range of literature was carried out to determine the essence of the ASF, its presence in the Chinese market, and its impact on the price distribution of pig meat and other meat types. Using Google Scholar, PubMed, and Web of Science, the literature was carried out using the keywords “ASF”, “price distribution” “impact”, “viral outbreak”, and “governmental measures”, among others. To gather all necessary and relevant information, more than 30 references—including articles, raw data, and case studies—from the pertinent literature were used. The ASF outbreak and its impact-related papers were selected to form the background of the study.

Pig prices, the total number of reported ASF-infected pigs, and the stock quantity of live pigs are all taken into consideration for sample collections. To discuss the impact of ASF on the Chinese meat market, secondary data was used to answer the “how much” and “how many” questions. The official websites of the Chinese Ministry of Agriculture and Rural Affairs, Professional Pig Community, OECD, and World Bank provided the raw data on pig production and price distribution. Microsoft Excel program was utilized to perform graphical analysis for descriptive statistics. The t-test, Pearson correlation coefficient, and polynomial regression statistical techniques were employed in the subsequent sections to conduct regression analysis and strengthen the correlation between the chosen variables. To determine the correlation coefficient between the picked data, the price per kilogram of pig meat was first used as the control variable. Other meat varieties, such as chicken, beef, and mutton, were then employed as independent variables. Second, the link between the price level of pig meat and the ASF outbreak was assessed using the outbreak’s findings as control variables. The statistical techniques and graphs were conducted in R statistical software (Posit team (2024), RStudio, Integrated Development Environment for R. Posit Software, PBC, Boston, MA, USA. URL: http://www.posit.co/).

Afterward, using data gathered from 2017 to 2021, this paper also investigates the connection between China’s live pig supply and price fluctuations. Monthly statistics on the number of live pigs in stock (in millions) and the associated price (in RMB per kilogram) are included in the dataset.

The study looks for trends in the relationship between the price of live pigs and their stock by doing a regression analysis of the data. In a nation like China, where pork is a staple food and an important component of the national economy, this will help evaluate how changes in supply (the stock of pigs) have affected price fluctuations and offer insights into the wider effects of disease outbreaks on agricultural markets. In polynomial regression, pig price is dependent and stock is the independent variable.

The study’s assumptions are the following:

Assumption 1: the ASF viral outbreak highly impacted the Chinese market.

Assumption 2: as a consequence of the viral outbreak disruption, a negative correlation can be observed between the decreased pork production and the price level of pork meat.

Assumption 3: a demand change can be expected as a result of price level change.

Figure 1 looks at China’s pork consumption from 2015 to 2021. It shows some of the disruptions China’s pork consumption patterns have encountered. Pork consumption in China changed when the ASF outbreak happened in August 2018. As an influence of the viral outbreak, the alimentation habits of people in China have changed, which affected the production as well. Since the demand-supply chain has changed, as a substitute for pork, demand for poultry shows an observable tendency across years, especially those of 2019 and 2020, in other words, while in pig consumption we see a fall-down, poultry consumption increases. Beef and sheep consumption does not show a huge difference in alimentation habits, not after the outbreak which influenced deeply the market of the pig.

The number of infected pig population instances is shown in Figure 2. The impact of ASF on the Chinese hog business is evident. There is a peak between 2019 and 2020. Only reported cases can be received until January 2020 due to data limitations.

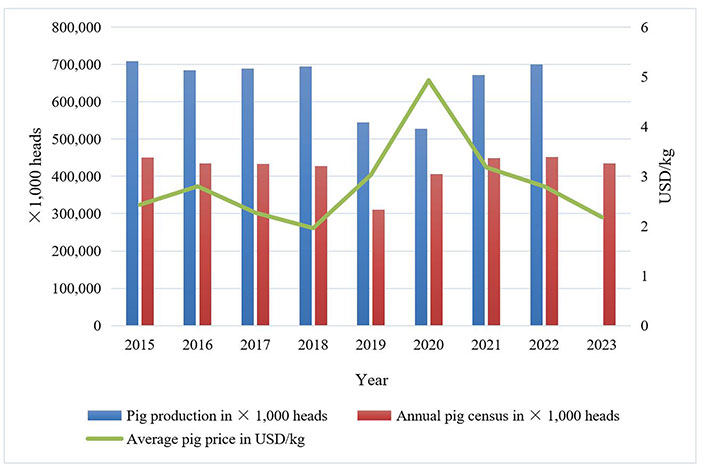

In Figure 3, pork production can be observed during the selected period. China’s annual pork production reached 708 million heads in 2015. After 2016, and 2017, a slight drop can be noted in pig supply. The difference between 2015 and 2016 is 23 million heads. A decrease can be spotted in pig production in 2019. ASF highly impacted the overall production of swine in the China market during the time slot. The literature also shows that ASF is one of the most serious diseases in the pig industry in recent years which deeply affected the market [7]. In 2019 the annual pig production in China stands for the exact heads of 544,190,000. Almost in four years, the annual pig production from 2015 to 2019 dropped by over 160 million heads. In less than one year, the annual pig production from 2018 to 2019 covers 149,630,000 fewer heads. In 2020, the annual pig production stands for over 525 million heads, which is 19 million fewer heads compared to 2019.

In Figure 4 the total pig census includes breeding sows, piglets, and fattening pigs below 110 kg, as well as includes fattening pigs over 110 kg. The interdependence shows how the chosen variables correlate. In 2018 pig census presented 428,171,000 heads. The numbers dropped from 2018 to 2019, from 428 million to 310 million heads. In the following year, the total pig census was contradictory to total pig production, showing an increasing level; since the government made actions, there were more pigs officially registered and controlled [14].

Annual pig production, annual pig census, and annual price of China between the years 2015 and 2023 (measured in USD/kg)

In 2015, the average price of a pig was 2.43 USD/kg. Although there was a minor price increase the next year, the average price of pig per kilogram in 2017 was USD 2.27, a USD 0.16 decrease from the year before can be noted. Pig prices initially rise and then sharply decline, despite the output and pig census showing a rising level between 2015 and 2017. While pig production and census data indicate a decline, the price of a pig per kilogram increased dramatically between 2018 and 2019.

Overall, as shown in Figure 1 and Figure 2, the disruption of the ASF outbreak in China significantly altered the supply-demand balance and consumption patterns. Due to significant production gaps (Figure 3), the supply fluctuated, which in turn caused the demand to either rise or stagnate. The disturbance resulted in a change in the supply-demand balance, which raised the price of pig heads per kilogram. Referring to Figure 4, the price of pigs per kilogram grew significantly in 2020. The price difference between 2019 and 2020 climbed by USD 1.9. The average price of one kilogram of pig was USD 3.03 in 2019, but it increased significantly to USD 4.93 in 2020.

Approximately half of global pig production happens in China. The presence of a disease which shows a fatal tendency, has a major influence on the global food system and food security, as well as has a major impact on the supply chain and economy [24]. The projections of the effects of ASF reflect the major production shock that has occurred in the Chinese pig industry. Based on the findings of Shao et al. [30] by the end of October 2018, there were already 45 cases of ASF in China with 5,439 pigs infected and 3,841 pigs dead. To conclude, between 2017 and 2021 monthly data [28], there was a noticeable shift in China’s live pig supply and prices, according to descriptive statistics. The cost of live pigs varied greatly, with a median of 15.60 RMB/kg, a mean of 21.43 RMB/kg, and a range of 10.57 RMB/kg to 37.10 RMB/kg. This indicates a sharp rise in prices relative to stock levels, which may be an indication of how exogenous disturbances such as ASF have affected market dynamics.

Table 1 explains the pork meat types used as control variables during the analysis.

Explanation of abbreviations

| Code | Explanation |

|---|---|

| Live pig medium | Lives well-developed individual, sexually mature, approximately 140–300 kg |

| Piglet common | Live small pig, 0 to 3 years, approximately 1.5–50 kg |

| Pork deboned meat | Processed, deboned meat |

| Live cattle medium | Live breed, well-developed individual, 450–1,800 kg bulls, 360–1,100 kg cows |

| Beef deboned meat | Processed, deboned meat |

| Live sheep medium | Live breed, well-developed individual, approximately 35–180 kg |

| Mutton deboned meat | Processed, deboned meat |

| Live chicken ordinary | Sexually mature chicken, approximately 2–4.5 kg |

| Chicken eggs ordinary | Chicken egg, size S, M, L |

Table 2 employs the Pearson correlation coefficient’s regression results. The price of chicken will increase in tandem with the price of pig, indicating a positive and robust link. Market equilibrium and the supply-demand response are the causes of the positive association. Because the infected stock was removed from the market, the ASF had an effect on pork production, which in turn led to a scarcity. The pig sector had a shortfall, which led to a decrease in pork production and an increase in the quantity of demand. Because of the positive correlation found in the statistical regressions, the cost of other meats, such as lamb, cattle, and poultry, will likewise rise. It leads to the demand shock reaction as part of the fundamental supply-demand balance and its stable nature. People’s eating habits have also changed as a result of the viral pork illness. People are therefore more likely to purchase poultry than infected pigs. The rising demand curve directly correlates with an item’s price increase. As more individuals choose to purchase chicken instead of pigs, the price of chicken increases. Different kinds of meat can be shown to have a similar relationship. There is typically a strong and positive correlation. Our study’s main finding on the positive correlation is that, as a result of the ASF-induced scarcity, the price of pigs is directly correlated with the price of chicken, beef, or lamb.

Panel data regression results

| Meat (type 1) | Meat (type 2) | Pearson correlation | P-value | Correlation type | Correlation strength |

|---|---|---|---|---|---|

| Live pig medium | Piglet common | 0.958496 | 5.04E–53 | Positive | Strong |

| Live pig medium | Pork deboned meat | 0.99805 | 4.775403E–115 | Positive | Strong |

| Live pig medium | Live cattle medium | 0.878612 | 6.25E–32 | Positive | Strong |

| Live pig medium | Beef deboned meat | 0.888971 | 1.21E–33 | Positive | Strong |

| Live pig medium | Live sheep medium | 0.743561 | 4.07E–18 | Positive | Strong |

| Live pig medium | Mutton deboned meat | 0.783125 | 4.22E–21 | Positive | Strong |

| Live pig medium | Live chicken ordinary | 0.718582 | 1.68E–16 | Positive | Strong |

| Live pig medium | Chicken eggs ordinary | –0.02146 | 0.835624 | Negative | None |

| Piglet common | Pork deboned meat | 0.955103 | 1.87E–51 | Positive | Strong |

| Piglet common | Live cattle medium | 0.88383 | 8.97E–33 | Positive | Strong |

| Piglet common | Beef deboned meat | 0.902744 | 3.32E–36 | Positive | Strong |

| Piglet common | Live sheep medium | 0.708177 | 7.07E–16 | Positive | Strong |

| Piglet common | Mutton deboned meat | 0.755883 | 5.51E–19 | Positive | Strong |

| Piglet common | Live chicken ordinary | 0.635272 | 3.60E–12 | Positive | Strong |

| Piglet common | Chicken eggs ordinary | –0.20743 | 0.042575 | Negative | Weak |

| Pork deboned meat | Live cattle medium | 0.889636 | 9.26E–34 | Positive | Strong |

| Pork deboned meat | Beef deboned meat | 0.898957 | 1.83E–35 | Positive | Strong |

| Pork deboned meat | Live sheep medium | 0.759088 | 3.21E–19 | Positive | Strong |

| Pork deboned meat | Mutton deboned meat | 0.797619 | 2.35E–22 | Positive | Strong |

| Pork deboned meat | Live chicken ordinary | 0.733198 | 2.00E–17 | Positive | Strong |

| Pork deboned meat | Chicken eggs ordinary | –0.01044 | 0.919618 | Negative | None |

| Live cattle medium | Beef deboned meat | 0.992704 | 3.60E–88 | Positive | Strong |

| Live cattle medium | Live sheep medium | 0.911916 | 3.91E–38 | Positive | Strong |

| Live cattle medium | Mutton deboned meat | 0.949343 | 4.77E–49 | Positive | Strong |

| Live cattle medium | Live chicken ordinary | 0.795623 | 3.54E–22 | Positive | Strong |

| Live cattle medium | Chicken eggs ordinary | 0.078004 | 0.449999 | Positive | None |

| Beef deboned meat | Live sheep medium | 0.867309 | 3.13E–30 | Positive | Strong |

| Beef deboned meat | Mutton deboned meat | 0.917141 | 2.50E–39 | Positive | Strong |

| Beef deboned meat | Live chicken ordinary | 0.815107 | 5.18E–24 | Positive | Strong |

| Beef deboned meat | Chicken eggs ordinary | 0.027988 | 0.786632 | Positive | None |

| Live sheep medium | Mutton deboned meat | 0.990612 | 4.79E–83 | Positive | Strong |

| Live sheep medium | Live chicken ordinary | 0.675894 | 4.18E–14 | Positive | Strong |

| Live sheep medium | Chicken eggs ordinary | 0.247344 | 0.015115 | Positive | Weak |

| Mutton deboned meat | Live chicken ordinary | 0.73592 | 1.33E–17 | Positive | Strong |

| Mutton deboned meat | Chicken eggs ordinary | 0.215434 | 0.035033 | Positive | Weak |

| Live chicken ordinary | Chicken eggs ordinary | 0.406848 | 3.90E–05 | Positive | Moderate |

Table 3 shows that the reported cases of infected heads are strongly correlated with three different forms of pork meat: boneless pork, medium-sized live pigs, and common piglets. Given that the p-value for the price of medium-sized live pigs and ASF cases is 0.00145, it is evident that the variables are correlated. Our results show that the p-value is less than 0.05. In this instance, it is necessary to reject the null hypothesis, which is commonly thought of as statistically significant. The table demonstrates that the p-value for each of our variables is less than 5%, indicating the association’s critical importance.

Panel data regression by using the Pearson correlation coefficient between different types of pig meat

| Type | Pearson’s statistics | p-value |

|---|---|---|

| Pearson correlation between the price of live pig (medium size) and of ASF cases | 0.6129267559747918 | 0.0014505463055572748 |

| Pearson correlation between the price of piglet (common) and ASF cases | 0.6438135980574735 | 0.0006871976620941374 |

| Pearson correlation between the price of pork (deboned) and ASF cases | 0.6009032358930967 | 0.0019011859057351495 |

ASF: African swine fever

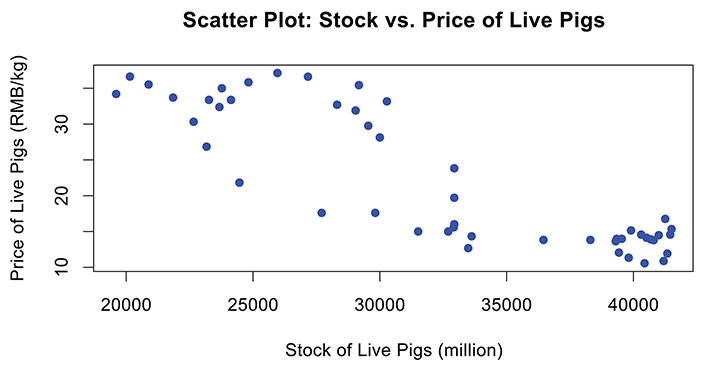

In Figure 5, the scatter plot displays the correlation between the price of live pigs (in RMB per kilogram) and the stock of live pigs (in millions). The graph shows a definite nonlinear, negative relationship: prices tend to fall as the number of live pigs grows. This is especially noticeable for stocks over 30,000 million, where prices drop precipitously. Lower stock levels (less than 30,000 million) have higher pricing and more volatility.

Correlations between pig stock and price of live pigs (units in million and RMB/kg)

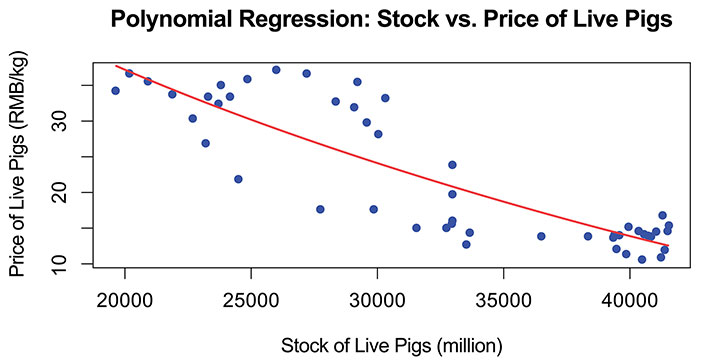

In Figure 6, the relationship between the price of live pigs and their stock is modeled by polynomial regression degree 2. With an adjusted R-squared value of 0.7465, the model demonstrates a strong fit, accounting for roughly 74.65% of the variation in live pig prices. At the 0.1 level, the polynomial’s first-degree term (the linear component) is significant (p = 0.0829), indicating a considerable contribution to the explanation of the price fluctuations. There is no support for the curvature effect, though, as the second-degree term (quadratic component) is not statistically significant (p = 0.4698). The F-statistic shows that the total model is statistically significant (p < 0.0001), which supports the addition of a quadratic term to investigate the nonlinear relationship. A respectable forecast accuracy is indicated by the residual standard error of 4.689.

Polynomial regression between pig stock and price of live pigs (units in million and RMB/kg)

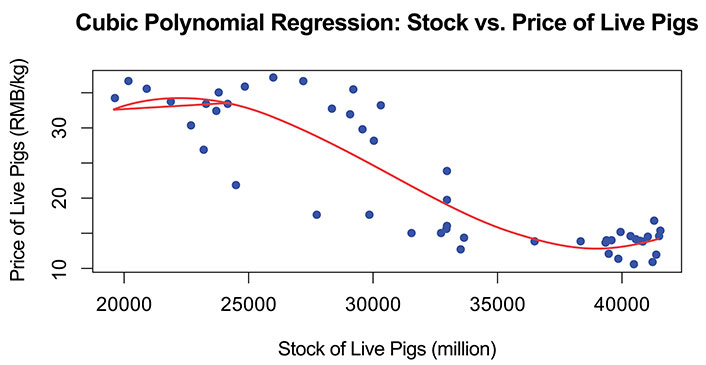

In Figure 7, a more complex nonlinear link between the price of live pigs and their stock is captured by the degree 3 polynomial regression. The model has a high degree of explanatory power, as evidenced by the adjusted R-squared (0.7795), which explains 77.95% of the price fluctuation. Each of the three terms—linear, quadratic, and cubic—contributes significantly to the explanation of price swings, as evidenced by their statistical significance. The relationship is further complicated by the cubic term, which may indicate oscillations that are not captured by straightforward quadratic models. The residual standard error of 4.373 indicates a high capacity for prediction.

Polynomial regression between pig stock and price of live pigs (units in millions and RMB/kg)

Model fit: a greater percentage of variability is explained by the degree 3 model (adjusted R2 = 0.7795) than by the degree 2 model (adjusted R2 = 0.7465).

Significance of terms: the degree 3 model justifies the extra complexity because all three terms—linear, quadratic, and cubic—are significant, but the degree 2 model’s quadratic term was not statistically significant.

Residual accuracy: the degree 3 model exhibits better prediction accuracy by having a smaller residual standard error (4.373) than the degree 2 model (4.689).

The degree 3 model is a better option for examining the connection between pig stock and price since it has a higher overall fit and significance.

Nutrition significantly impacts people’s eating habits in the modern world. In the food sector, food supply safety is an unavoidable factor. People’s awareness of food safety and production levels is steadily growing. Understanding the relationship between a virus outbreak in the food industry and food systems makes it easier to measure in managerial decisions. As a food source and economic engine, China’s pork industry plays a vital role in the nation’s agricultural economy. The price of live pigs has fluctuated in China in recent years due to several factors, including government policy, disease outbreaks, and market supply and demand. The 2018 ASF epidemic, which had a significant negative influence on the swine population, was one of the most noteworthy occurrences affecting the pork market. The ASF viral disease, its infectious level, potential consequences, and its effect on price distribution in the Chinese market are all examined and summarized in this study. China produces the most pork worldwide and is one of the world’s largest consumers of pork. The world’s highest rate of pork eating is found in China. According to the regression study, the ASF outbreak caused a 25.8% decrease in hog production in 2020, and the resulting shortage of meat caused prices to nearly triple. The impact of the disruption is evaluated from the perspective of production, price level, and consumer eating habits in the area.

The main findings of this paper are as follows based on the assumptions.

Assumption 1 is testified. An accurate summary of the ASF’s effects can be found in the literature. Since the initial publication of ASF, not only China but also other countries have been struggling to recover from the shortages brought on by the illness. Different managerial and governmental measures were introduced to combat the impact and prevent inflammation.

Assumption 2 is testified. The two variables are negatively correlated. As the production decreases, demand increases, and the price of pork increases as a consequence of shortage and higher outbreak levels.

Assumption 3 is testified. Consumers moving to non-pork foods, or shifting pig consumption patterns are concluded from the research. Demand shock caused by ASF and disturbances resulted in a shift in eating patterns. Consequently, the effect resulted in several declines in the production and price levels of meat. Furthermore, it is probable that the existence of ASF has impacted and continues to influence both supply and demand. Demand may shift in reaction to a decline in confidence in the product’s quality and safety.

Finally, the research details in this paper are summarized. Limitations are sample bias as the ASF in China is quite recent; measuring the long-term effect is limited, but are possible directions for future research.

ASF: African swine fever

GDP: gross domestic product

OECD: Organization for Economic Co-operation and Development

The author wishes to acknowledge the China Ministry of Agriculture and Rural Affairs for providing detailed data on the topic. The journal conforms to the guidelines set forth by the organizations. The author also wants to express gratitude to Dr. Yong He, Teo Parashkevov, and Richard Molnar for supporting me during the research period.

MS: Conceptualization, Investigation, Writing—original draft, Writing—review & editing, Data curation, Formal analysis, Validation.

The author declares that there are no conflicts of interest.

Not applicable.

Not applicable.

Not applicable.

The raw data supporting the conclusions of this manuscript will be made available by the author, without undue reservation, to any qualified researcher.

Not applicable.

© The Author(s) 2025.

Open Exploration maintains a neutral stance on jurisdictional claims in published institutional affiliations and maps. All opinions expressed in this article are the personal views of the author(s) and do not represent the stance of the editorial team or the publisher.

Copyright: © The Author(s) 2025. This is an Open Access article licensed under a Creative Commons Attribution 4.0 International License (https://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, sharing, adaptation, distribution and reproduction in any medium or format, for any purpose, even commercially, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.